Housing assets reflect a further recovery in price appreciation

Widely considered a mainstream asset class, offering considerable upside potential in terms of capital appreciation over the medium to longer term as well as a favourable rental income stream, residential property owners and investors will be encouraged by the further recovery in house price appreciation in South Africa.

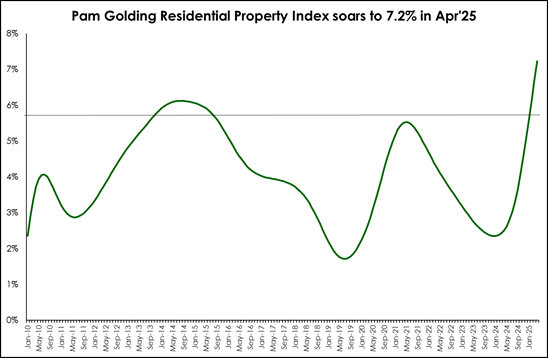

Says Dr Andrew Golding, chief executive of the Pam Golding Property group: “On the back of the recently-announced (29 May 2025) reduction in the repo rate, further positive news for homeowners and residential property investors is that the recovery in house price inflation (HPI) continues to gather momentum, soaring to a robust 7.2% in April 2025 from year-earlier levels, according to the latest Pam Golding Residential Property Index.

Source: Pam Golding Residential Property Index

“This surge in appreciation in housing assets is well above the two previous cyclical peaks and the strongest growth rate in national house prices since late-2007. For 2025 to date, national HPI has averaged 6.4% which is double the average for 2024 – which was 3.2%.

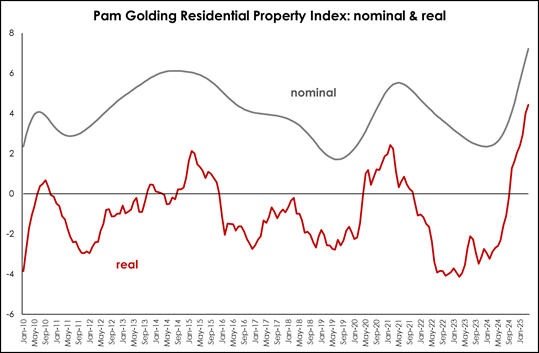

Source: Pam Golding Residential Property Index & Statistics South Africa

“Furthermore, given that inflation remains anchored below the lower 3% inflation target limit, real, inflation-adjusted house prices rose by +4.4% in April, which is an almost 20-year high. For 2025 to date, real house price inflation has averaged 3.4%.”

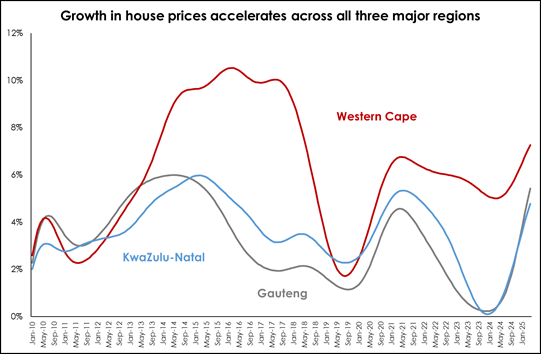

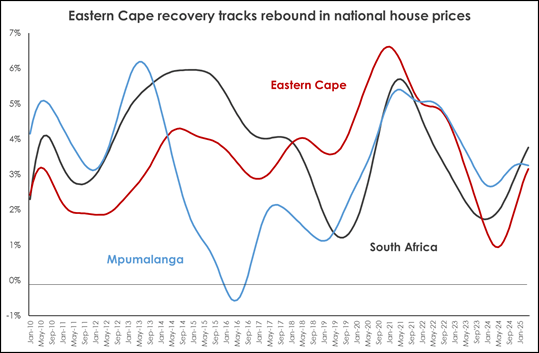

According to the Pam Golding Residential Property Index, growth in house prices has accelerated across all three major regions. Although the recovery in Western Cape HPI leads the way at +7.3%, the strengthening rebound in Gauteng of +5.4% and KwaZulu-Natal’s +4.8% is closing the gap, while the recovery in Eastern Cape HPI continues to track the national recovery, with prices rising by +3.2% in April. Meanwhile, revised growth in house prices in Mpumalanga peaked at +3.3% in early-2025 before easing marginally to +3.25% last month (April).

Source: Pam Golding Residential Property Index

Source: Lightstone

In regard to coastal vs non-coastal homes, revised coastal HPI has rebounded ahead of non-coastal house prices, rising by +5.0% and +3.7% respectively in April. Interestingly, while the recovery in non-coastal HPI began in early-2024, in contrast, growth in revised coastal house prices only began to accelerate once more in Q3 2024.

Meanwhile, a strong recovery in sectional title house prices resulted in a convergence with freehold HPI at +3.9% in April.

Adds Dr Golding: “Regionally, Cape Town continues to outperform other major metro housing markets by a wide margin, rising by +6.2% in April, followed by an upwardly revised Tshwane at +2.4%, while the recovery in Johannesburg HPI of +1.8% continues to strengthen in tandem with eThekwini at +1.9% – the ninth consecutive month in positive territory for the latter.

“Positively, house price inflation in the coastal market in Nelson Mandela Bay rose to +3.0% in April.”

For further information visit www.pamgolding.co.za

Posted by The Know - Pam Golding Properties