There was a good case for hiking repo rate by only 25bps (instead of 50bps), says Dr Andrew Golding

Given the fragile state of the local economic recovery, with high unemployment, rising poverty levels and household finances under pressure from rising prices – including the prospect of another significant hike in the fuel price next month (June) as government’s temporary R1.50 per litre general fuel levy subsidy ends, one could argue that any increase at all in the repo rate would over-burden consumers and further dampen the economy. This is particularly so given the toll that persistent loadshedding and the recent KwaZulu-Natal flooding are taking on the economy, says Dr Andrew Golding, chief executive of the Pam Golding Property group.

Says Dr Golding: “Locally, the primary concern for the MPC is the impact that the resurgent inflation rate is having on inflation expectations. Prior to the war in Ukraine, the Reserve Bank had managed to anchor inflation expectations around the mid-point of the inflation target – which provided scope for the Reserve Bank to aggressively cut interest rates in the early stages of lockdown, providing a buffer for economic activity during the pandemic. Now, however, there are signs that elevated inflation is impacting inflation expectations, resulting in recent above inflation wage demands in both the public and private sector.

“Furthermore, in the wake of the Fed’s recent 50bps interest rate hike and the rapid normalisation of monetary policy globally, together with rising oil prices and renewed weakness in the Rand, it seemed inevitable that this would be the fourth consecutive MPC meeting at which an interest rate hike would be announced, following three previous increases of 25bps each. It has been stated that South Africa needs to normalise interest rates (from pandemic-induced lows) in line with the Fed, to avoid further Rand weakness at a time of soaring global food and energy prices.

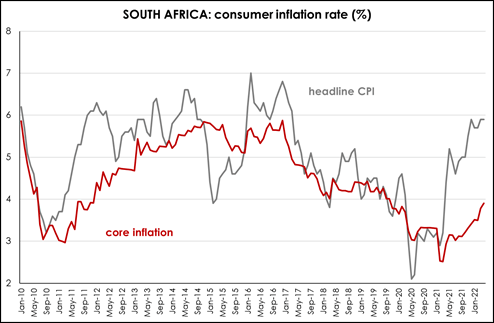

“Nevertheless, we had hoped that any increase would be only 25bps, not the 50bps widely forecast. In addition to the weak economy, the case for hiking by only 25bps was further supported by the fact that core inflation remains below the mid-point of the Bank’s inflation target at just 3.9% in April, while the headline inflation rate remained unchanged at 5.9% last month – marginally below market expectations and just within the upper limit of the inflation target.

SOURCE: Statistics South Africa

“The impact on South Africa’s residential housing market is not expected to be significant, especially as this is still the lowest level of prime interest rate (now 8.25%, up from 7.75%) in more than two decades (prime was 8.5% between July-2012 and Dec-2013). For example, for a homebuyer with a bond of R1 million over 20 years, and a prime rate of 8.25%, payments will increase from R8 209 per month to R8 521.

“According to ooba, the average approval rate for 100% bonds inched higher from 81.3% in March to 82.8% last month, the highest rate for the year to date, with the approval rate for first time buyers at 79.9%. This indicates that financial institutions still demonstrate a strong and competitive appetite for lending.

“Bearing in mind that the desire among our country’s sizeable young generation of savvy, aspirational citizens is to own their own homes, and that activity in the marketplace is also fuelled by people relocating for a variety of lifestyle and other reasons, we are optimistic that the residential property market will continue to retain its resilience, as evidenced over the years despite numerous economic and other challenges.

“Positively, for the financial year ended February 2022, Pam Golding Properties has experienced its busiest year ever, however, it is too early to forecast if the gradual upward repo rate cycle will have any significant impact on market activity.”

For further information contact Pam Golding Properties via headoffice@pamgolding.co.za or visit www.pamgolding.co.za.

Posted by The Know - Pam Golding Properties