Upsurge in demand for residences in secure lifestyle estates

The rapid transition to working from home during the hard lockdown, which has resulted in many businesses opting to continue operating in this manner or at least partly so, coupled with the ongoing requirement for social distancing, has spawned an upsurge in demand for residences within secure, lifestyle estates, says Dr Andrew Golding, chief executive of the Pam Golding Property group.

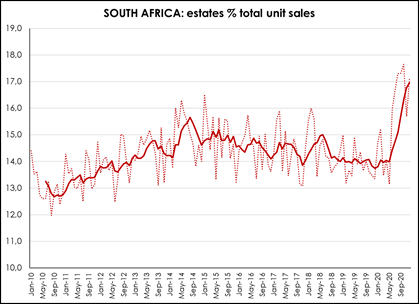

“Once the hard lockdown began to ease and activity in the housing market rebounded strongly, estates accounted for a significantly larger percentage of total units sold, rising from 13.1% in May 2020 to 17.1% by December 2020* – the highest percentage recorded over the past 10 years. (*Latest available statistics)

“If we trace back a decade, while activity in the national housing market has slowed in recent years, estate sales have remained relatively consistent as a percentage of total units sold. In 2010, estates accounted for 13% of all units sold, rising steadily to 15% in 2014 before easing marginally to 13.9% in 2019 – a trend which continued into the first few months of 2020, before increasing markedly from May last year.

Source: Lightstone

“While residential estates, and in particular those easily accessible to major hubs and cities, have consistently retained their appeal due to the secure lifestyle, attractive ambience and community-minded approach, it stands to reason that the lockdown restrictions have underscored the benefits of access to safe open spaces for exercise, sports and recreation; more spacious homes; reduced exposure to those outside of family and close friends; and on-site facilities such as child-minding, shopping, schools and other activities. With some estates also offering affordably priced sectional title units and retirement components, as well as luxury homes and apartments, estates have cast their net far wider providing access to a broader market of potential home buyers.

“And with loadshedding expected to continue, the fact that many estates prioritise ‘green’ living, becoming increasingly self-sufficient in regard to energy and water, or even completely off the grid, further makes the case for investing in an estate home away from congested city life.”

Source: Lightstone

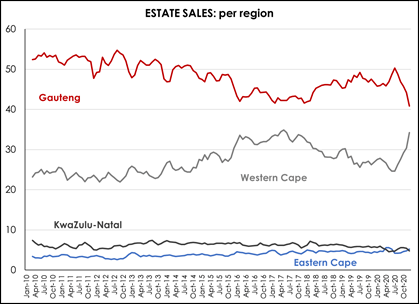

While Gauteng continues to account for the largest share of national residential estate sales, over the past decade the Western Cape has been steadily gaining ground – noticeably so during the recent 2020 surge in estate sales, to the extent that in regard to estate sales during the month of December 2020, the Western Cape overtook Gauteng province, says Dr Golding.

| % total | 2010 | 2015 | 2020 | ‘Dec-20 |

| Gauteng | 52.7 | 47.5 | 45.7 | 35.3 |

| Western Cape | 24.5 | 28.6 | 28.4 | 40.6 |

| KwaZulu-Natal | 6.3 | 6.6 | 5.1 | 4.2 |

| Eastern Cape | 3.4 | 3.8 | 4.8 | 5.5 |

Source: Lightstone

“Notably, the Eastern Cape, which accounts for less than 5% of estate sales, has been gradually gaining market share and by December last year accounted for a slightly larger share of the market than KZN.

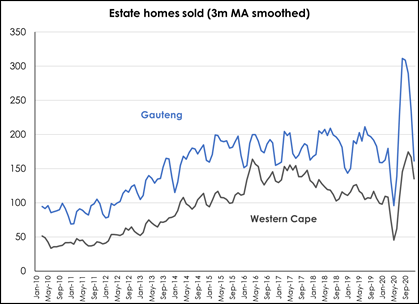

“In regard to Gauteng, while this province may have seen a decline in total market share of estate sales, it has retained a very similar number of top-end (>R3 million) estate sales (see chart below).

“Although total Gauteng estate sales (as a percentage of total sales) declined sharply in the second half of 2020 (graph above), it actually recorded a sharp increase in top-end estate sales (see graph below), suggesting the weakness in unit sales was registered in the other price bands.”

Dr Golding adds: “Notwithstanding the fact that the Western Cape dominates in the top-end sectional title market overall, it remains marginally smaller than the Gauteng market for top-end estate sales, which is probably attributable to the fact that the Gauteng estate market is far larger than the Western Cape estate market.”

Source: Lightstone

| <R1.5 million | R1.5 – R3 million | >R3 million | |

| Gauteng | |||

| 2010 | 73.9 % | 19.4 % | 6.7 % |

| 2020 | 49.5 % | 32.9 % | 17.6 % |

| Western Cape | |||

| 2010 | 80.3 % | 13.0 % | 6.7 % |

| 2020 | 50.3 % | 32.7 % | 17.0 % |

Source: Lightstone

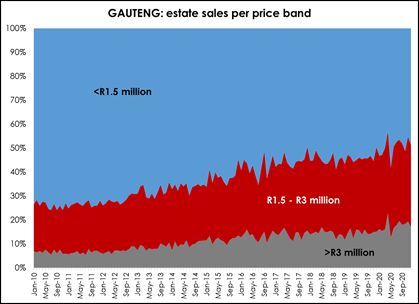

Says Sandra Gordon, Pam Golding Properties senior research analyst: “In Gauteng, unit sales in estates valued at under R1.5 million declined from 73.9% of total estate sales in 2010 to just under half (49.5%) by 2020, while the percentage of top-end (>R3 million) units sold more than doubled, rising from 6.7% in 2010 to 17.6% in 2020.

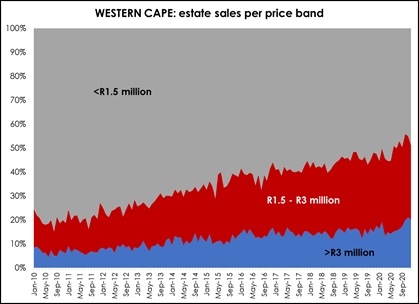

“The distribution of estate homes sold according to price bands is very similar in the Western Cape. The total of homes priced below R1.5 million was higher in the Western Cape in 2010 but by 2020 was in line with Gauteng at around half of all estate homes sold in both regions.

“In 2010, Gauteng estate sales saw a slightly larger percentage in the R1.5 million to R3 million price band, however, by 2020 both regions had nearly a third in this price band. In both provinces, the percentage of sales in the top price band showed very similar growth.”

Source: Lightstone

Source: Lightstone

For further information contact Pam Golding Properties via headoffice@pamgolding.co.za or visit www.pamgolding.co.za

Posted by The Know - Pam Golding Properties